calsfoundation@cals.org

Panic of 1837

The Panic of 1837 was the first financial panic to hit America during the Free Banking Era (1837–1863). Like most economic panics, it was caused by both internal and external factors. New states in the South like Arkansas faced decreased value in land, cotton, and the slave trade. The depression lasted until around 1844, with the country’s economy rebounding because of new commodities and later solidifying after increased access to gold deposits in the American West after the Mexican War.

Origins of the Panic of 1837

At the time Arkansas was becoming a state in 1836, the American economy was expanding. The land in Arkansas, especially in the southeastern portion of the state, grew in value because of the cotton that land could produce. High tariffs on imported goods increased federal revenue. European prosperity in the 1830s stimulated the American economy. Silver was being imported into the United States, while wheat and cotton were valuable exports. The land that produced wheat and cotton was valuable, but its value was overestimated. The Midwest, and the Upper South, saw prices outgrow the value of the land. In addition to land speculation driving high prices, private banks were issuing paper currency with no substantive backing. Expensive land and flimsy banking contributed to the Panic of 1819, and similar factors came into play in 1837.

A year before the financial panic started, the Bank of England decreased its investment in American goods, mainly cotton, to grow its monetary reserves. This led to a default on loans for cotton producers throughout the South. In addition, the wheat exports dropped because England had abundant harvests, while the American harvests had faltered. Most notably, infestations and harsh winters destroyed the American grain industry. American banks tried addressing the issue of credit and interest rates, but the recent demise of the Second Bank of the United States at the behest of President Andrew Jackson meant that centralized fiscal policy was hampered. Most citizens in Arkansas supported Jackson and opposed centralized banking. Lastly, a real estate bubble burst, which in turn hurt the banks and investors who had hoped that new lands opened up in new states, like Arkansas, or regions once lived in by Native Americans, would bring good returns on investments.

Effects of the Panic of 1837

Mercantile factories and credit systems suffered across the nation. States that had debt felt the most pressure, although almost every state felt the economic sting. Hundreds of banks closed, and some banking systems reported losses in the hundreds of millions of dollars. Arkansas and other southern states in the Cotton Belt suffered the worst of any region in the country. The reliance on cotton production and exportation made their regional economies the most susceptible to decreased cotton prices. Plantations across the South collapsed. Fortunately for Arkansas, it had a smaller population and less expensive overhead for its agricultural economy. States like Alabama and Louisiana, however, had more negative effects of the panic that hurt investments and investors. Some states defaulted on the loans they got from Great Britain. This hurt international commerce, since not only was the British economy not benefiting from a healthy cotton industry in America, but now they could not expect to collect the finances they extended to Southern planters.

The Arkansas State Bank lacked sufficient funds because of the panic—it was not until 1838 that the bank had enough funds to open. There was a decrease in specie and in state bonds. The federal government, via the War Department, bought $300,000 worth of state bonds from Arkansas (roughly $9.5 million in 2023 currency). It began to distribute resources to different bank branches in growing regions of the state, including Arkansas Post (Arkansas County), Fayetteville (Washington County), and Little Rock (Pulaski County). The shaky footing of the bank ultimately led to its collapse in 1843. The first amendment to the state constitution passed in 1846, barring banks from operating in Arkansas.

Aftermath of the Panic of 1837

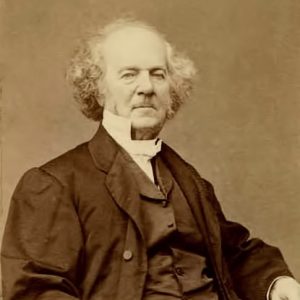

After five rocky years, the financial stability of the United Staes economy began to return by 1842. By the end of the 1840s, England and Dutch creditors had increased their interest rates, which—in addition to the California Gold Rush—helped boost the money supply in the United States. One of the byproducts of the Panic of 1837 was the introduction of the credit rating industry. One of the pioneers of the industry, Lewis Tappan of New York, was a staunch abolitionist. He employed his anti-slavery connections to help him create a nationwide network of people who would report on the status of different businesses and their credit.

For Arkansas, the Panic of 1837 hurt its young banking industry. Furthermore, the depression stymied the state as a whole, which came into the Union just before the economic downturn began. Ultimately, Arkansas would have roughly fifteen years of economic headaches stemming from the panic and its effect upon land, cotton, and banking. By the 1850s, the economy rebounded in the state. When the Panic of 1857 struck the country, Arkansas weathered the financial storm much better than it had twenty years earlier.

For additional information:

Arnold, Morris S., et al. Arkansas: A Concise History. Fayetteville: University of Arkansas Press, 2019.

Irwin, Douglas A. Clashing Over Commerce: A History of US Trade Policy. Chicago, IL: University of Chicago Press, 2017.

Panic of 1837. Harvard Business School. https://www.library.hbs.edu/hc/crises/1837.html (accessed January 3, 2024).

Paulson, Alan C. Roadside History of Arkansas. Missoula, MT: Mountain Press Publishing, 1998.

Sobel, Robert. Panic on Wall Street: A History of America’s Financial Disasters. New York: Beard Books, 1999.

Worley, Ted R. “Arkansas and the Money Crisis of 1836–1837.” Journal of Southern History 15, no. 2 (1949): 178–191.

Michael J. Megelsh

Blue Mountain Christian University

Business, Commerce, and Industry

Business, Commerce, and Industry Louisiana Purchase through Early Statehood, 1803 through 1860

Louisiana Purchase through Early Statehood, 1803 through 1860 Lewis Tappan

Lewis Tappan

Comments

No comments on this entry yet.